EditMe made its 350th Kiva loan recently as part of our ongoing lending program (this post is actually a little late, and the current number is at 369). Since October 2007, EditMe has made between two and four new Kiva loans per week, and has recycled the repaid loans (now totaling 242) back into additional loans. Deferred revenue from customers' 6 and 12 month prepayments help to fund these loans. Additionally, EditMe donates 10% of each loan directly to Kiva to cover their operating expenses.

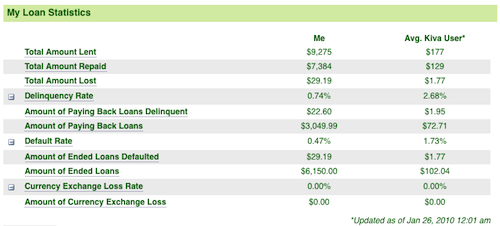

So far, this represents a total outlay of $9,275 and has touched the lives of hundreds of entrepreneurs in developing countries to start or grow their businesses. EditMe's pool of 369 loans currently shows a default rate of less than 1/2 percent (0.47%) and a delinquency rate of 0.74%. Compare that to the US SBA default rate of at least 17%.

Part of this success is due to the "group" nature of many of these loans. As Kiva explains on their web site:

Group loans are a powerful innovation in microfinance, because they are often less expensive for partners to manage in terms of time and resources. In a group loan, each member of the group receives an individual loan but is part of a group of individuals bound by a 'group guarantee' (sometimes called 'joint liability'). Under this arrangement, each member of the group supports one another and is responsible for paying back the loans of their fellow group members if someone is delinquent or defaults.

About Afde Group No. 19 - Afde group No.19 is led by Ms. Maymouna Diop, aged 50. Since her husband's retirement, she has been working as a vendor to make ends meet. Like many women in the market, she sells palm oil and smoked fish. Ms. Sarr Diop, aged 40, is the group's treasurer. She also sells smoked fish, in addition to various vegetables and has been active in the trade for 17 years. She is married and the mother of five. The other three members of the group are: Fatou Kébé, who has a small breakfast stall, Aissatou Ndao and Awa Ndiaye who sell vegetables. Each member recieves a loan of 100,000 FCFA to reinforce their activities.

The following table provides some detailed statistics for EditMe's lending program:

Also see EditMe's Kiva lender page and previous updates #1, #2, #3, #4, #5, #6 and #7.