EditMe made its 300th Kiva loan today as part of our ongoing lending program. Since October 2007, EditMe has made between two and four new Kiva loans per week, and has recycled the repaid loans (now totaling 187) back into additional loans. Deferred revenue from customers' 6 and 12 month prepayments help to fund these loans. Additionally, EditMe donates 10% of each loan directly to Kiva to cover their operating expenses.

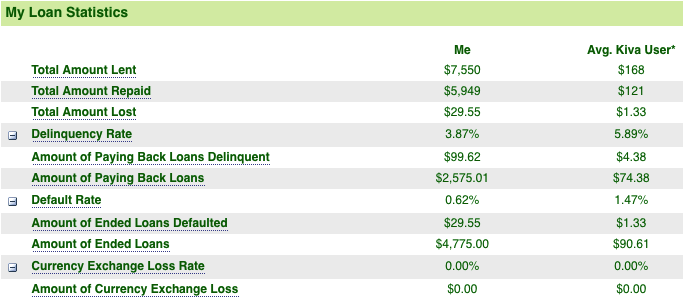

So far, this represents a total outlay of $7,550 and has touched the lives of hundreds of entrepreneurs in developing countries to start or grow their businesses. EditMe's pool of 300 loan currently shows a default rate of less than 1 percent (0.62%) and a delinquency rate of 3.87%. Compare that to the US SBA default rate of at least 17%.

Part of this success is due to the "group" nature of many of these loans. As Kiva explains on their web site:

Group loans are a powerful innovation in microfinance, because they are often less expensive for partners to manage in terms of time and resources. In a group loan, each member of the group receives an individual loan but is part of a group of individuals bound by a 'group guarantee' (sometimes called 'joint liability'). Under this arrangement, each member of the group supports one another and is responsible for paying back the loans of their fellow group members if someone is delinquent or defaults.

About Luz Divina 1 & 2 Group - Rosa is the group coordinator of the group Luz Divina (Divine Light). Her story is representative of the other members of her group as well as of Esperanza's Haitian and Dominican (many of whome recently moved from Haiti to the DR) clients more generally. Rosa's group is based in the industrial town of Los Alcarrizzos, a dusty city north of the capital where both running water (none of which is potable) and electricity are unreliable at best. Here she makes her home in a simple structure of cement walls and a tin roof with her husband and five school aged children. Her business is also located in her home.

Rosa has shown herself to be a reliable Esperanza client by completing one loan cycle with out problems. She is excited to take her next loan and with it she plans to invest in her business by purchasing a hair dryer, curling iron and hair products to sell in her store. She believes this will improve her profits and with those profits she plans to purchase school supplies for her children and hopefully a computer so that they will be able to learn about technology. In the future she hopes that God will help lead her children down the correct path and that He will bless her with the ability to provide for her children what they need. She tanks you all for your support.

The following table provides some detailed statistics for EditMe's lending program:

Also see EditMe's Kiva lender page and previous updates #1, #2, #3, #4, #5 and #6.